As Joe Biden and congressional Democrats hire thousands of new Internal Revenue Service agents to audit middle-class taxpayers, the agency reports tens of thousands of federal employees are brazenly cheating on their taxes.

A report from the Treasury Inspector General for Tax Administration reveals 42,047 federal employees have repeatedly refused to file federal income tax returns, cheating the government out of over $1.5 billion in revenue as of 2021, the Washington Times reports.

“Repeatedly not filing a tax return when a taxpayer is required to do so is a brazen form of noncompliance. Federal civilian employees with tax delinquencies have a legal and ethical requirement to be current with their tax obligations,” the report finds.

“TIGTA found that tax compliance among federal employees has been trending down in recent years. As recently as 2017, just 108,000 employees were delinquent in filing or paying. But in 2021, that rose to 149,000 cases, out of a federal workforce of 3 million. That works out to a delinquency rate of about 5 percent,” the Times reports.

“The Postal Service had the most offenders, with more than 9,000 employees who missed at least two years. The Veterans Affairs Department was runner-up with nearly 6,600 employees,” the Times added.

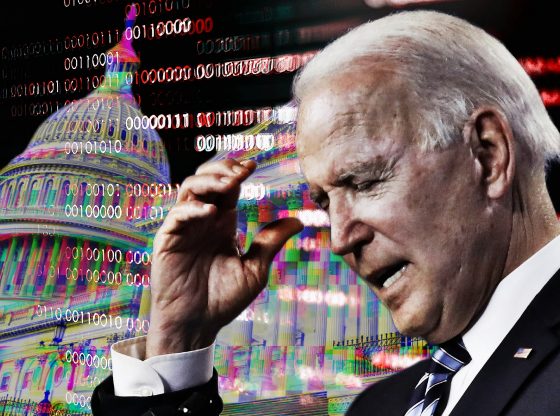

The report comes as Biden and Democrats drastically increased IRS staffing ahead of plans to step up audits, claiming they will only be aimed at the very rich.

But the IRS already boasts 10,000 agents, compared to just 735 billionaires in the U.S., more than enough to fully audit every billionaire.

Instead, Biden’s new IRS agents will be aimed at the middle class.

“Democrats’ tax and spending spree will more than double Americans’ chances of being audited as it targets lower and middle-income earners. The proposal will lead to an additional 1.2 million IRS audits each year, nearly half of which will hit middle class families making less than $75,000. All this so Democrats can wring an extra $200 billion out of the American people, particularly from middle-class families and small businesses,” House Ways and Means Committee Republicans report.

& IRS does nothing

What can you say other than, “Hypocrites”.

I don’t understand! If I don’t file forms, I don’t get back some of the money government steals every paycheck . I don’t get that money! This article states that the government looses!?! How?

Prosecute then OK