A stunning new survey conducted by intelligent.com has now revealed that 1 in 10 of those with student debt are still paying it off 20 years later.

A finding which underscores the true scale of the student debt crisis which has been festering in America for years.

A driving factor in the debate about student debt cancellation is the fact that, for a variety of reasons, a significant number of borrowers are unable to pay off their loans in the standard 10-20 year repayment period, meaning individuals could be carrying debt that they took on in their late teens well into middle age, or beyond.

…

Overall, 27% of people surveyed borrowed money from the federal government to pay for school. Of that group, 61% are still paying off those loans.

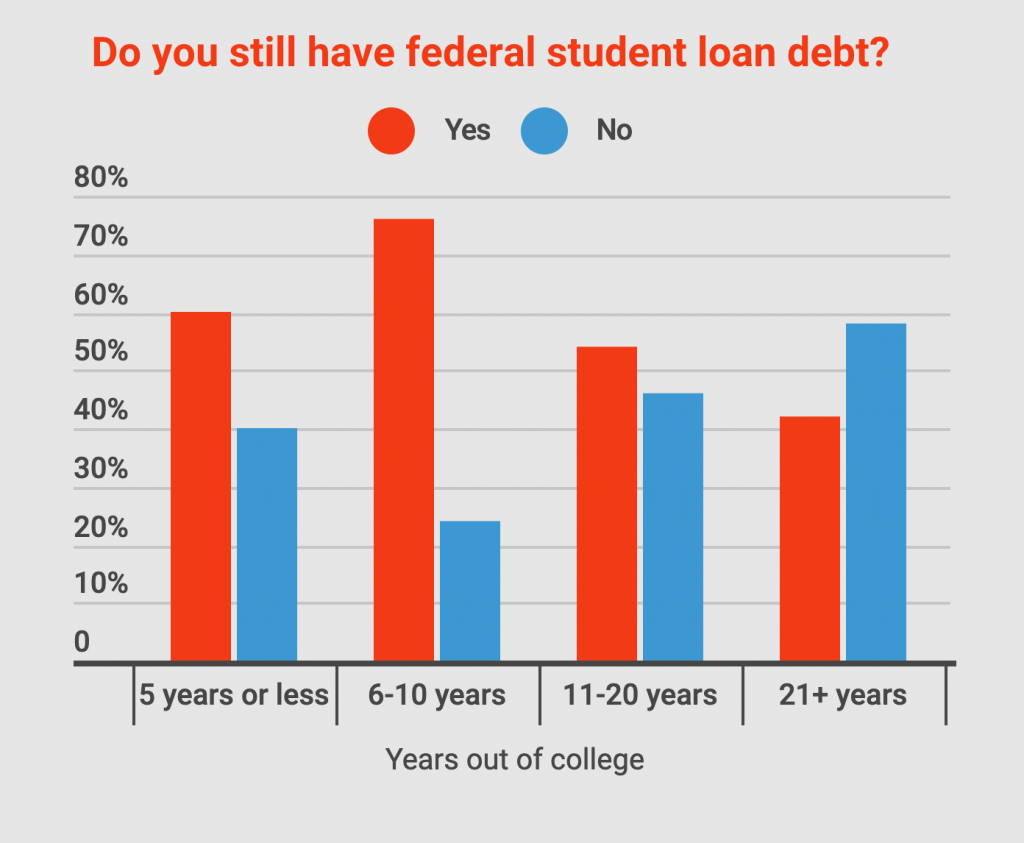

The percentage of people paying off student loans is highest among individuals who have been out of school for 6-10 years. Seventy-six percent of people in this group, including those who graduated and those who left school without completing a degree, say they are still paying off student loans.

Given that standard federal student loan repayment plans are based on a minimum 10-year period, this isn’t striking. However, our survey found that a significant number of borrowers are still paying off loans well beyond that. Fifty-four percent of borrowers who left school 11 to 20 years ago, and 42% of those who left college more than 21 years ago, are still paying off their loans. Forty-five percent of people who left school more than 21 years ago still owe between $10,000 and $49,999, as do 43% of people who left school 11 to 20 years ago.

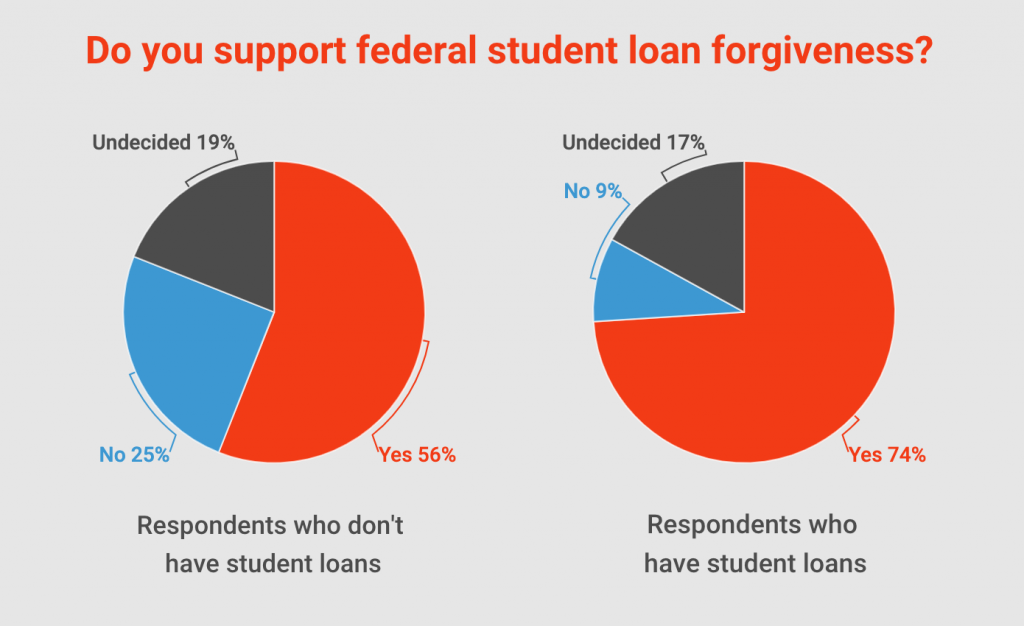

The crisis has gotten so bad that a majority of those holding student debt now believer their only way out may be via intervention from the federal government:

Will we see mass student loan forgiveness in the near future, and if we do, will it be justified? Let us know what you think in the comments below.

You can read the entire survey HERE.

I would go for paying off student loads as more productive measure than half a cozen of the fake infrastructure garbage being pushed through congress surently.

My neighbor’s aunt makes 62 every hour on the internet..iil she has been without work for eight months but the previous month her revenue was 19022 only working on the laptop 5 hours a day.. check this …… Paybuzz1.com

My neighbor’s aunt makes 62 every hour on the internet.. HAz she has been without work for eight months but the previous month her revenue was 19022 only working on the laptop 5 hours a day.. check this …… SmartPay1.com

We have enough largess to underwrite without tacking on the loans for Ivy League freeloaders. There’s no requirement for a person to attend college, and if they’re motivated enough to obtain financing for their tuition, then they should take care of those obligations and not saddle taxpayers with their expenses.

I agree with you, David. I think one thing that discourages repayment in a timely manner is the entitlement thinking that once they are out of school (and even during) they should have it all – or the best – not second hand – not wait, but instead take out more loans for more stuff. Aren’t we all tempted to have the latest tech items, new cars, complete wardrobe…..you name it? The desires to have so much in our materialistic society keeps many with student loans from placing priorities on their loans. Heck, the government allows you many extensions on repaying your loan!!

They deserve the best if they apply themselves, obtain advanced degrees and contribute. What they DON’T deserve is our taxes to pay off their loans. I no longer donate money to charities or PACs because Americans have spoken, and they put a blithering idiot–along with a laughing hyena–in power. The clown is a billionaire, so if they need money, he’s going to be their source

Don’t these idiots think ahead? I was careful to borrow what I knew I could pay off, and did it in 10 years. I worked, while going to school. I counted pennies. Of course, my education got me a better job, with more money, too. Unlike today’s social degrees…..

Agreed. One avenue for education on the public dole is to attend military academies. Of course, you’ll be obligated to serve in some military capacity once you graduate, but you’ll have premium credentials and experience to present to perspective employers.

People play this game by bleating the notion that those loan papers they signed had disappearing ink. Now they’re trying to use the government–hence, our taxes–to bail them out of their obligations. I say no. Declare bankruptcy, restructure your installments, moonlight. If they want those college credentials, then they need to pay, and debt is a necessary evil if they can’t plop down the full amount of tuition fees.

Why cant colleges use endowments for Fin aid & reduce debt overall

More can be done

Merge programs, combine rates, tier rates etc Compete