The debut of an instant payment service that is due to be introduced in the summer of 2023 was announced by the Federal Reserve on Monday. According to a description from the central bank, FedNow, which it has been building for the last few years, is meant as a “flexible, neutral platform that allows a broad variety of rapid payments” so that customers can instantly transmit money through their financial institutions. Lael Brainard, vice chair of the Federal Reserve, stated that FedNow will “change the way routine payments are done throughout the economy” during a speech to developers.

As The Daily Wire reports:

“Immediate availability of funds could be especially important for households managing their finances paycheck to paycheck or small businesses with cash flow constraints,” she explained. “Having the capacity to manage money in real time could help households avoid costly late payment fees or free up working capital for small businesses to finance growth.”

Among other examples, FedNow is set to eliminate merchants’ need to wait one to three days before payments are finished depositing, as well as the need for workers to wait days before receiving paychecks. Retailers currently pay an average interchange fee of $0.23 when consumers use debit cards, according to data from the Federal Reserve, which FedNow hopes to significantly undercut.

“Americans rely on the payment system all day every day to make purchases, pay bills, and get paid — without ever needing to consider the complex infrastructure that is operating under the hood,” Brainard added. “American households and businesses want and deserve payment transactions that work seamlessly, reliably, and efficiently.”

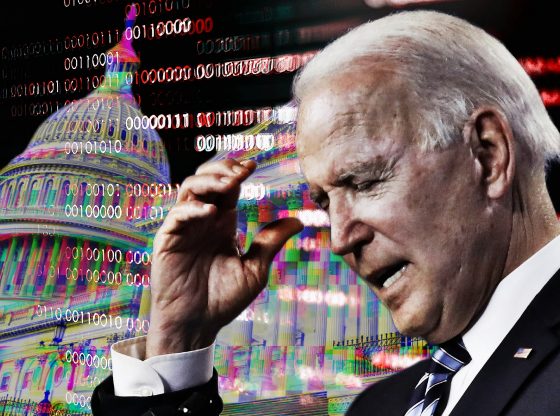

The move comes as the central bank also considers the creation of a “central bank digital currency” (CBDC) that would work as an alternative to other digital assets — including cryptocurrencies, which are virtual coins protected from counterfeiting via encryption, and stablecoins, which attempt to peg themselves to another asset such as gold or the dollar. Federal Reserve Chair Jerome Powell told lawmakers last year that he had no desire to hasten the project.

Total Bull crap people this is nothing more that a tracking device to see there and what your spending you money on which is none the feds G D business. more BIG BRO. Bull sh*t from the Buffoon and his Obamy lackies.

The Federal is acting like they are a business. They aren

t and the American people have had enough of you. The fact is there are a bunch of talentless people out there. All they know how to do is set behind a personal computer. Watch how things are grown and built. Its time to put an end tocareer politicians. They have lost sight of what our true values are as a Nation.

Speaking of business- the government couldn’t run a whorehouse in a mining camp and break even.

The Federal Reserve is a for profit corporation who’s international headquarters is in Puerto Rico. It has 12 owners with permanent seats on it’s board. The IRS is it’s wholly-owned subsidiary collection agency!

Whenever the Feds mess with your money……it means that they will find a way to take it from you. That’s a fact.

wELL tHE MORE THEY MONITOR WHAT YOU GET AND WHAT YOU SPEND IT ON, THE CLOSER WE GET TO AN AUTOMATED TAX SYSTEM. NO MORE TAX RETURNS, THEY WILL FILL IT OUT FOR YOU AND SEND YOU THE BILL TO PAY.

This is so they can Take your money, cut you off if you arent vexed or claiming satan as your god. The Lord called it: You wont be able to buy or sell without a number and HERE IT IS whalaa

Digital payment system??

Interesting…..I don’t trust a damn thing the feds do, supposedly under the guise of good, bad or indifferent. These are the feelings they themselves have caused after all of their corruption. It’s always about control!

I’m going to start paying by check and see if the financial institutions can figure out that archaic payment system.

Here we go the first steps.

That means banks will toe the line and therefore, so will we,

because no one seems to know what to do.

Well, I still pay all my bills by paper check

and do my taxes by paper form.

The government that’s trillions wants to help us manage our money. Hmmm, maybe when they show us, they can manage the taxpayer money they already have control of we can talk.

Central bankers own the federal reserve, this is the gateway to digital currency, which is inline with World Economic Form