If President Joe Biden gets his way, the business of filing taxes in 2022 will be more complicated, more expensive, and more progressive than they’ve been in about 40 years.

Biden didn’t say much about taxes during the 2020 campaign besides his promise that those making less than $400,000 a year would not see their tax bill rise by “one thin dime.” The proposals he’s put forward as “payfors” for infrastructure, COVID relief, and other new spending programs are riddled with new taxes and hike existing levies to the point one can safely say the era of “tax and spend” has returned, in a punitive, almost vengeful way.

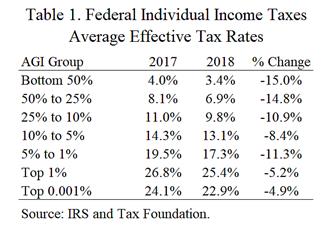

As the Committee to Unleash Prosperity observed Monday in its free daily Hotline, the top 5 percent of U.S. income earners pay half of all income taxes while the top 1 percent – the left’s favorite whipping post – pay more than 40 percent of the total tax intake. Meanwhile, as the chart below shows, the bottom half of income earners have an effective federal tax that’s close to zero – even when payroll and gasoline taxes are factored in. Quoting the Cato institute’s Chris Edward, “Joe Biden’s comments about the rich having low rates are clearly off base. The highest earners have tax rates twice the income of those in the middle and almost ten times the rates at the bottom.”

Biden’s plan to “soak the rich” is more about politics than economics. The numbers don’t add up and, if his tax cuts are enacted at the same time the United States is trying to emerge from a prolonged, lockdown induced recession, the results could be inflationary and job-killing rather than spark renewed growth in the economy as the 2017 Tax Cuts and Jobs Act did. Nonetheless, the Democrats are, as a party, committed to TCJA’s repeal in its entirety and, in the process, violate Biden’s campaign pledge.

Republicans on the House Ways and means Committee said Monday that if Biden gets his way on TCJA, it will do families “real harm” even at the median income level. A family of four with a household income of $73,000 could expect to see its federal taxes increased by $2,000. A single parent with one child should plan to pay $1,300 more.

Additionally, the committee said, the child tax credit would be cut in half as would the standard deduction, millions of middle-class households would again have to pay the Affordable Care Act individual mandate tax, and the American corporate tax rate would once again become the highest in the industrialized world.

The policies of tax and spend reached their apex in the 1970s under Jimmy Carter. America literally can’t afford to go back. The inflation alone would have a potentially ruinous impact on government discretionary spending. No Democrat who claims to be a moderate could go along with Biden’s plan to undo any part of tax-cutting, job-creating law Congress passed in 2017 – especially given what the president has planned for phase two. The prudent force forward is to keep the rates where they are, reduce overall federal spending, and let the U.S. economy boom. There will be plenty of money later to do the things we’ve already put off doing over the last four years, economists say, once the country is flush again.

Peter Roff is a former U.S. News & World Report contributing editor now affiliated with several Washington, D.C. public policy organizations. He appears regularly as a commentator on the One America News network. Reach him by email at [email protected]. Follow him on Twitter @PeterRoff.

I hope everyone who voted for this ass-clown get hit the worst.

I hope that they die broke

And half to pay double the taxes and loose every thing.

Tax and spend, spend and tax , pay to play, their policy has never changed.

I can’t hold back anymore. BIDEN and his BUNCH are the WORST we have ever had in Washington. Their only plan is to DESTROY OUR BEAUTIFUL AMERICA. It will come to mass MURDER, RAPE , THEFT, PILLAGING, DESTROYING THE JEWISH AND CHRISTIAN BELIEFS WHICH AS LONG AS I AM ALIVE WILL NOT BE FORGOTTEN AND EVERY OTHER FORM OF CRIME TO GET RID OF EVERYONE OF US WHO LOOK CROSS EYED AT THE DEMOCRATS. SOCIAL COMMUNISM MY ASS. AS ONE GREAT AMERICAN SAID. ” GIVE ME LIBERTY OR GIVE ME DEATH”. I AM AN AMERICAN CHRISTIAN AND DO NOT FEAR DEATH LIKE PELOSI AND HER MOB.

if we cut off the head of the serpent it will no longer exist

that head is the bosses of all of these corrupt politicians. Yes the super rich. Just make sure you really cut this super rich hesd off, You will still have the division, the people that can’t think, the followers (you know lemmings). If you know history, even the revolutionary war (which becaame a world war), was frought with bad decisions, lack of individual states supporting it, a good amount of luck, sacrifice by many. Can this happen again because all empires have a life span and the US by far is not the longest or shorts but somewhere in the middle if we fall now. Me I am obviously hoping for the “NOT FALL NOW THING”. WILL WE AS A PEOPLE BE ABLE TO SHOW THE SAME GRIT, BAVERY THAT OUR FOR FATHERS DID? I hope so.

This is simple. A new law that requires all congressional members and appointed cabinet to pay the highest tax rate, regardless of their gross income, that the tax law requires will help them experience high taxes and curb their excitement on taxing others. Democrats should love that. Come on squad, you can make it happen.

Then Americans shouldn’t pay their taxes. It will take them years to find or get to 75 million people, assuming Dems will just go along with the idiot they put in office.

It seems that there are 2 views. Those who believe the corporate media and academia (and now big tech), believe that the wealthy don’t pay “their fair share” (although nobody is willing to define what that is) of the taxes. These people are not evil, they are mis-informed. They don’t realize that uber-wealthy folks in the media, Academia, and big tech are lying to them … while hiding most of their own wealth. They don’t understand that money is mobile … and that it will go where it is treated the best. Punishing success and rewarding dependence will never work long term. These propaganda specialists even have folks screaming that we go to the forms of government and economics that have caused untold suffering and death just in the last century. I wish I had a solution as to how to educate these people, but they’ve been indoctrinated or brainwashed so well … and it’s a whole lot easier to complain and blame others than to see one’s own failures. If you borrowed $150K to get that masters in gender studies and now you’re working as a barista … you can assess where you made bad decisions and start to dig yourself out of your self-inflicted hole … or you can ignore your bad decisions and blame the mythical 1% evil people (meanwhile worshiping folks who are in the 1% but have you convinced that they are there for you. No idea how to convince people that minimal government and personal and governmental fiscal responsibility is the only sustainable way forward.

Senile Democraps sleepy Joe Biden and giggles Kamala, must face an elected Republican controlled US House and Senate in 2023!

If there were only a way to make Joe Biden and his corrupt gang pay ALL the tax increases, how many increases do you think would actually happen? Wake up America! You are being bamboozled by the crooked Democrat Party and Joe Biden, the fraudulent president. Don’t stand for it! Never, ever again vote for a Democrat for ANYTHING!

This faithless and deceptive feathermucker will not hike our taxes by ‘one thin dime.’ NO, instead He will hike them all by 6,000 dimes at least.