World leaders united at the G20 summit to announce their support of a global minimum tax to prevent large corporations from evading taxes.

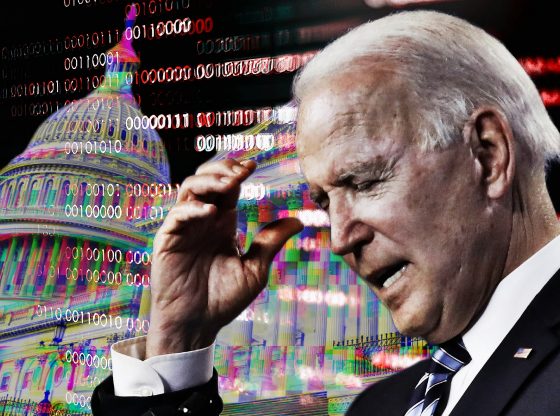

“Here at the G20, leaders representing 80% of the world’s GDP — allies and competitors alike — made clear their support for a strong global minimum tax,” Biden tweeted. “This is more than just a tax deal – it’s diplomacy reshaping our global economy and delivering for our people.”

Biden had previously pushed for a 21% tax rate, but at a 15% global minimum, the U.S. is set to earn $60 billion a year in revenue by eliminating the tax incentives for corporations to operate overseas.

In the current economy, multinational corporations can avoid paying out on profits by assigning earnings to subsidiaries in countries with low tax rates. As of 2016, half of U.S. corporate revenue was assigned to foreign tax havens, but the G20 announcement could render them useless.

Under a global minimum tax, companies with annual revenue over $864 million would pay at least 15% in the nation they are headquartered in, and any earnings that allocated towards tax havens will occur a top-up tax in the organization’s home country, which would guarantee they paid the full 15% tax.

“The deal works because it removes the incentives for the offshoring of American jobs. It’s going to help small businesses compete on a level playing field, and it’s going to give us more resources to invest in our people at home,” a senior administration official said.

“It’s a game changer for American workers, taxpayers, and businesses, and in our judgment, this is more than just a tax deal – it’s a reshaping of the rules of the global economy.”

G20 finance ministers had agreed to a global minimum tax in July, but the Saturday announcement out of the summit in Rome marked their official endorsement.

The opinions expressed by columnists are their own and do not necessarily represent the views of AmericanActionNews.com

Corporations do not evade taxes they pass the cost on to the consumers. Another clueless move by our feckless geriatric in chief.

My sainted Mother used to say: ‘There’s no fool like an OLD fool.’

Trust the Liars?

This deranged imbecile of a so called president is a complete and total fool, but he always was a fool.

If I remember my American History correctly, wasn’t there some reference to the phrase, “taxation without representation” way back at the start of the Revolution?

This is the first act of our new World Government

Yup, “IT”___ is Underway. LIFE as we Knew it, is OVER. And we’re ALL gonna FAIL.

WORLDWIDE COMMUNISM, comrade.

Get assigned a Number and a Duty .

UNBELIEVABLE.

Obamacare was exactly that. It was never presented as a tax or voted on as a tax but Roberts said it was a tax.

sounds good but then so does everything free sound good. The problem is at least two fold. 1) will these taxes actually be paid or will they go back to the rich that support the power and 2) will these taxes not show up in the price to us, the consumers in the end??? I think on both cases the rich dems will win big time…

Does anyone think there will not be one country that “doesn’t belong”, who looks at this and drops the corporate rate to 0 to attract corporate headquarters being established there. (Like N.J. with corporate headquarters).

WHOEVER has the Most money will WIN…. the SAME as since Day Fukking One in this World.

Corrupt, dirty, handsy Uncle Joe screwing everyone every which way while taking money under the table from China, Ukraine and Russia! Most unfit, inept, incompetent clown President ever!!

PURE SCUM, to be sure. Got a Great kid, though!

😂

CLASSY Wife, too. Reeeeeeal High Quality wench! The Three Biden’s can’t all go to any church together, that would be a prohibited SIN OVERLOAD for ONE House of God.

More of the socialist (read communist) breakdown of America. Big business funds big government and passes the cost on to us.

NEW WORLD ORDER is Upon us.

Unbelievable is ALL I can say.

I hope they all enjoyed their time at the “Spa” And the fake ghost of Biden, can keep his taxes. GESARA is coming and the whole World shall benefit for a change God is good and God has won

Joe Biden promises the world that the United States will give away it’s ass and Crap through its Sleave!

Of course all the other countries want this it is called one world government and no sovereignty for all!

Get rid of all these commie pedophile democrat cult party members from all offices!

WOW!, IS THIS BAD! GLOBAL COMMUNISM!

They can paint this SHIT as Anything they want to, BUT IT IS GLOBAL COMMUNISM!

You mean his handlers woke him up long enough to vote, probably without even knowing what he was voting on? “Sleepy Joe” reminds me of Henry Blake having Radar place things in front of him to sign without telling him what they are for. MASH was funny, Washington is not.

Who in the heck do you think gets hurt by this tax??? The consumer!!! It is a pass on, why don’t you(Biden) understand that?!!

UNBELIEVABLE.

GLOBAL COMMUNISM is ALL THIS IS.

New Biden chant – POOP-OOP-A-DOO-DOO

Does these people of the G 20 know how much this is going to cost their countries? This has been debunked by so many economists but the won’t pay attention to the conservatives! Moronic At Best!