Washington, D.C. – The economic rebound that began as the pandemic-related lockdowns started to end in the states is producing strong results throughout the United States despite the considerable rise in inflation. While higher prices are wiping out the income gains workers made during the pre-COVID boom, the surging stock market helped the amount of money held in private retirement accounts reach some of the highest levels on record.

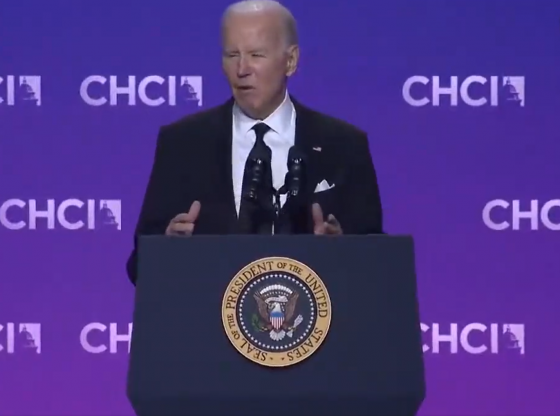

The number of 401(k) and IRA millionaires have hit all-time records, CNBC’s Jessica Dickler reported Thursday, suggesting good times may still be ahead even though the perception is growing that President Joe Biden and his economic team are mismanaging the economy. In the most recent IPSOS poll, 55 percent of those surveyed said they were “pessimistic” about the direction of the country, an increase of 20 points over late April when the question was last posed. Pessimism, the polling firm said, was rising across all age groups and income levels and was even down among Democrats.

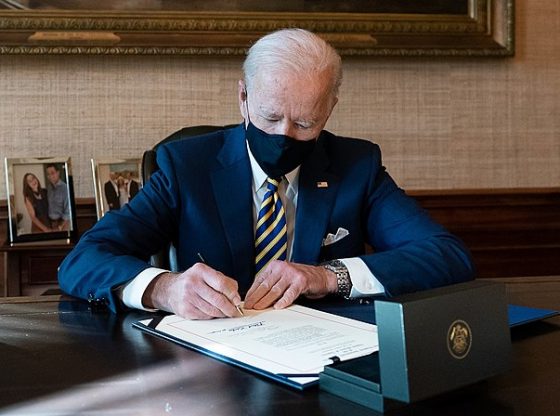

The Biden economic plan includes higher taxes and increased spending despite the recurrence of notable inflation. If it passes, it would likely cause a contraction in an economy that has appeared to be growing again since people started going back to work after many of the nation’s governors – mostly from the so-called “Red States” – stopped the pandemic-induced unemployment emergency bonus payments that more than one prominent economist identified as a significant disincentive for people to get back on the job.

For retirees and investors, meanwhile, the surging stock market and the steady increase in retirement account balances is welcome news considering how badly these holdings fared during the government-imposed lockdowns, losing considerable value in many cases. According to data provided by Fidelity Investments, the nation’s largest manager of 401(k) savings plans, their overall average balance was up 24 percent from a year ago and hit $129,300 at June’s end. Individual retirement account balances were also higher, CNBC said, reaching $134,900, on average in the second quarter, up 21 percent from where they were a year ago.

American workers across the economy are participating in the wealth creation, not just the so-called “ultra-rich.” According to Fidelity, nearly 12 percent of workers increased the contributions they made to their plans over the period while a record 37 percent of employers also automatically enrolled new workers in their 401(k) plans.

This growth in the number of workers joining the investor class is a political problem for Biden and the progressive Democrats who control Congress. The tax, borrow, and spend plan they are trying to pass over an apparently unified Republican opposition includes, for the first time in decades, serious proposals to increase the tax on capital and returns on investment.

This step back towards the economic policies of the 1970s that produced high unemployment and high inflation – something the economic theories dominant in government and academia at the time said was an impossibility – would be a job killer. Yet, even above that, some Democrats are talking up the institution of a “wealth tax” assessed annually on total holdings rather than income as a “pay for” for policies progressives say they wish to enact like tuition-free community college, free pre-K childcare, and the transition of the U.S. to an economy based entirely on renewable energy. With Fidelity reporting the number of its plans “with a balance of $1 million or more” jumping to a record 412,000 in the second quarter of 2021 and the number of IRA millionaires also at an all-time high, the savings amassed in these accounts may prove an irresistible target for the wealth taxers if their proposals begin to gain momentum in Congress.

Peter Roff can be reached at RoffColumns AT GMAIL.com. Follow him on Twitter @PeterRoff.